“How do I know I’m getting a good price from my law firms?”

“How do I know I’m getting a good price from my law firms?”

That’s one of the most common questions we hear from in-house legal teams.

For example, say you work for a Fortune 500 in-house legal team and you need to engage outside counsel for an M&A matter.

It’s natural to ask:

Is the price we’re paying a good price for the work we receive?

Traditionally, that type of data simply hasn’t been available to in-house teams or firms — a fact that causes widespread discrepancies in cost across the legal industry.

At PERSUIT, we teach a process that brings transparency and visibility to the pricing of legal services — for both in-house teams and their firm partners.

In this article, we’ll show you the process we use to find what we call the “true market price” for a legal matter.

It may seem counterintuitive, but finding a true market price makes the price less important when you select your firm for a matter. By doing so, you can empower your team to better manage risk by choosing the best firm — not just the one with the best rate.

Note: PERSUIT is used by the world’s leading in-house legal teams to engage outside counsel in a way that’s more fair, more objective, more diverse, more equitable, and more effective for everyone involved. Learn more about PERSUIT.

Hourly Billing Gives You Little to No Information About the Value of the Work

When your in-house team uses billable hours, you have very little information about what a matter will cost at the beginning of the process.

For example, let’s say your team needs to engage outside counsel for an M&A transaction. If you’re like most in-house teams, you’ll have a panel or a preferred firm (or firms) you engage for M&A transactions — often with a pre-negotiated set of hourly rates.

For simplicity, let’s assume you’ve agreed to pay $750 per hour to your preferred M&A firm.

Is this arrangement fair? Is it a “true market price” compared to other firms who are equally capable of doing the work?

The truth is: You really don’t know, because you don’t know how long the firm will spend on your matter. So you have no information to judge whether $750 per hour is a fair price or not.

Maybe $750 per hour is the industry standard for that type of firm, but that type of industry standard doesn't tell you what your total fee will be. Without a scope for how many hours you expect for a matter, it’s like writing a blank check.

Hourly Billing From the Firm’s Perspective

Hourly billing makes it difficult to predict revenue from the firm’s side.

Imagine you’re a lawyer who knows a court well and has experience arguing before a judge. Thanks to your experience, you get a big multimillion-dollar case dismissed in just a few hours.

Is it fair that you’re paid a standard hourly rate — perhaps a few thousand dollars in total — for delivering that kind of value?

Incentivizing Results, Not Hours

The above example is a good illustration of how hourly arrangements incentivize hours (the more hours worked, the more money made), not results or value.

Hourly billing is why it’s traditionally been so difficult to know if you’re getting a fair price when engaging a law firm.

It’s also why it’s difficult to budget for legal — there just isn’t enough information using this model.

The True Market Price

A true market price happens when there is transparency and competition within a market.

For example, the prices for meals at similar restaurants are often similar, as is the price for construction services in a certain area, etc..

Legal services has not traditionally been a market where there has been transparency or competition, but that’s now starting to change.

In-house teams are under pressure to demonstrate their value to the business more than ever before — and to justify and document their decisions around external spend.

For all these reasons, legal teams are increasingly adopting a new process for engaging outside counsel — one that introduces these two elements: transparency and competition.

By doing so, they’re creating a situation where a true market price can emerge.

A Four-Step Process to Find the True Market Price for Legal Services

At PERSUIT, we teach in-house teams a process they can use to determine a fair market price for legal services.

Here’s how it works:

Step 1: Segment the matter by milestones and deliverables

Most legal work falls into repeatable patterns. You may not know exactly how a matter will go, but you know the types of activities that often happen.

For example, in litigation, you know there will be depositions, even if you don’t know exactly how many you’ll need. It takes some up-front work, but the process we recommend is segmenting a matter by each of the possible phases — including all the work that might need to be done (e.g. “deliverables”).

In our litigation example, those milestones and deliverables would include depositions, discovery, pre-trial, trial, appeals, etc. The same concept can be applied to advice or transactional matters as well.

Even in complex matters such as IP litigation, there are still patterns that repeat in phases, and certain types of work that happen within those phases. Things like the claim construction and the markman hearing can be scoped and outlined. It will take some up-front investment, but the process will yield a better environment for competition and transparency with your firms.

Companies using PERSUIT have access to a growing library of pre-built templates for dozens of types of matters — making the scoping process significantly easier.

Step 2: Invite preferred firms to submit proposals

After you’ve scoped your matter by phase, invite three to four of your preferred firms to submit proposals detailing how they’ll approach the work.

Ask them to submit their price estimate, a summary of how they’ll approach the matter, and any other information you’ll consider when awarding the work (DEI, relevant experience, etc.)

If you’re doing this manually, you can send emails inviting the proposals. (PERSUIT users can do this with a few clicks in the PERSUIT platform.)

When appropriate, some companies invite bidding firms to ask questions and further scope the matter, helping you ensure a true “apples to apples” comparison when you receive proposals.

Step 3: Use a competitive process

Sometimes, the proposals you receive will have similar price quotes.

In those cases, the competitive RFP process — on its own — has revealed a “true market price.” This gives you confidence that you’re not overpaying for the matter.

There are other cases where you’ll receive proposals with price estimates that are wildly different. In that case, you can’t know if the prices you’re looking at are a true “market price.” It may be that the firms simply don’t know what other firms are charging for similar types of services.

In this scenario, the process we recommend is a “reverse auction” — a competitive process where you set a time window, show the price quotes (or their rankings) you received from firms, then give those firms a chance to revise their price quote.

This is usually done as a live event with a time limit between 30 minutes to an hour.

Here’s an illustration of a real reverse auction taken from the PERSUIT platform:

At the start of the auction, there was a $1.275 million spread between the highest priced quote and the lowest.

One hour and six minutes later, the price spread had narrowed dramatically, with all four firms having price quotes within $270,000.

In this case, the “true market price" is about $1 million — the price the firms are grouping around at the end of the auction.

Step 4: Choose the firm you think has the best chance of giving you the result you need

At the end of this competitive process, you and your team can evaluate the proposals and make a choice about who to work with for the matter.

It may be counterintuitive, but a competitive process actually makes price less of a factor when choosing a firm.

Now your in-house team can engage a firm based on qualifications, experience, and expertise — not because of a price or a pre-negotiated discount.

If the highest priced firm at the end of a reverse auction is truly the most qualified firm, you might be completely justified in choosing them over a lower-priced proposal.

In fact, PERSUIT’s data — which include over $8 billion in proposals and $1 billion in legal work awarded through the platform — back this up.

When a reverse auction is used, we can see that the lowest-priced firm is selected only about half the time (51% to be exact).

The Payoff: Make Price Matter Less When Selecting Outside Counsel

Our internal data show — over and over again — that the competitive process detailed above takes large price differences out of the equation — empowering you to more heavily weight the experience, expertise, or proposed approach of a firm.

In addition, you’ll get the opportunity to review the approach each firm is proposing for your matter before you decide which firm to engage.

If we look again at the example we shared above, we can see why:

At the beginning of this auction, there’s little chance that an in-house team could justify paying an extra $1.275 million to engage with the highest priced firm competing for the work.

Not unless it was a “bet-the-company” type matter.

By the end of the auction, however, price was much less of a differentiator — because a true market price had emerged from the process.

And that’s the key.

In the end, while cost is always an important factor, what in-house teams really care about is managing risk and getting a favorable outcome — whatever that looks like.

By using a process that reveals a true market price, you make price matter less as you consider what firm you want to partner with.

One Last Thing: Will My Firms Participate or Get Mad at Me?

We also know that a common worry among in-house teams is that a competitive process (including reverse auctions) auction will damage the relationship they have with their firms — especially top firms.

But our data show exactly the opposite.

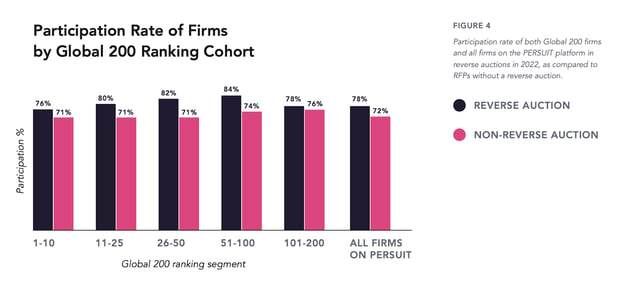

Looking at PERSUIT’s data about firms listed in the Global 200, on average, firms actually participate more frequently in RFPs with a reverse auction on the PERSUIT platform than they do when invited to an RFP without a reverse auction.

The trend also holds true for firm users across the entire PERSUIT platform, not just the Global 200. Here’s a graphic from our recent data report about reverse auctions showing those numbers:

In addition, we recently held a webinar discussing the relationship between in-house teams and their firms. It featured Gopal Burgher, partner at BurgherGrey, and Kimberly Williams, head of Legal Operations at SMBC.

As Gopal put it, from a firm’s perspective, a competitive process means they’ve made a short list of potential partners for a matter — and an opportunity they might not have had if a competitive process wasn’t used.

“My view of these things is that they present opportunities,” Gopal said, “and in some cases — opportunities that might not otherwise exist.”

“There’s a process that narrows down to a set of defined firms that they want to respond,” he added. “The fact that we made the list — that’s a plus for us. I look at it as an opportunity for us to showcase our stuff.”

You can view the full conversation about making a competitive process work for both firms and in-house teams here.

Note: PERSUIT is used by the world’s leading in-house legal teams to engage outside counsel in a way that’s more fair, more objective, more diverse, more equitable, and more effective for everyone involved. Learn more about PERSUIT.